Maximize Your Tax Savings with 2024 Section 179 Deductions on Used CNC Machinery

If you own a business in the manufacturing industry, you are always looking for ways to improve your operations while controlling cost. The Section 179 tax deduction is a great way to invest in quality used CNC machinery and reap some nice tax benefits. At Premier Equipment, we’re here to help you understand how these deductions can benefit your business in 2024.

Understanding Section 179 for 2024

Section 179 deduction allows a business to deduct the full purchase price of qualifying equipment purchased or financed during the tax year. The deduction limit for 2024 has increased to $1,220,000 with a spending cap of $3,050,000. What this means is that you can potentially write off the entire cost of used CNC machinery purchased from Premier Equipment so long as it goes into service by December 31, 2024.

Source: https://www.section179.org/section_179_deduction/

Key Benefits for CNC Machine Buyers

- Immediate Write-Off: Instead of depreciating your CNC machine purchase over a number of years, you can deduct the entire amount in the year you purchase it.

- Used Equipment Qualifies: Section 179 deductions apply to both new and used CNC machinery, making Premier Equipment’s high quality used machines a great option.

- Improved Cash Flow: By reducing your tax liability, you can reinvest the savings into your business, potentially funding additional equipment purchases or other growth initiatives.

How It Works with Premier Equipment

Suppose you buy a Haas VF-2 vertical machining center, which is used, from Premier Equipment for $ 75,000. Assuming you’re in the 35% tax bracket, here’s how the Section 179 deduction could benefit you:

- Equipment Cost: $75,000

- Section 179 Deduction: $75,000

- Cash Savings: $26,250 (35% of $75,000)

- Lowered Cost of Equipment: $48,750 ($75,000 – $26,250)

This illustration shows how the regulation of Section 179 can greatly reduce the actual cost of your CNC machine acquisition.

Bonus Depreciation in 2024

In addition to Section 179, bonus depreciation is 60% for 2024. There is more tax savings for larger equipment investments after spending reaches the Section 179 spending cap.

Why Choose Premier Equipment

As the leading provider of used CNC machinery, Premier Equipment offers:

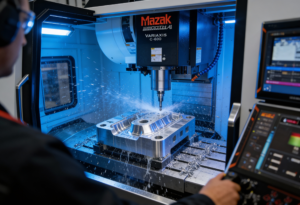

- A selection of high quality used CNC machines from top brands like Haas and Mazak.

- Over 120 years of combined sales experience in one expert sales team.

- Competitive pricing that, when combined with Section 179 benefits, is unbeatable value

Act Now to Maximize Your Savings

To get the full 2024 Section 179 deduction, you must purchase and place your CNC equipment into service by December 31, 2024. Take advantage now of the opportunity to upgrade your manufacturing capabilities with tax savings.

If you are interested in exploring our inventory of top of the line used CNC machines, contact Premier Equipment today and find out how you can use Section 179 to grow your business. We at our company have a knowledgeable team to help you find the right equipment that fits your needs and budget.

Note that although we at Premier Equipment certainly specialize in CNC equipment, as your tax status can relate to how aspects of Section 179 apply to your particular business, you most certainly want to speak with a tax professional to find out how they do.