As we look to 2025, folks in manufacturing are trying to stay hopeful even with all the challenges ahead. Recent signs say things might be improving, but manufacturers still have to deal with possible tariffs, fast tech changes, and ongoing workforce issues with the new Trump administration stepping in. This piece breaks down what’s influencing manufacturing as we head into 2025 and what leaders should keep in mind.

Economic Outlook and Policy Impact

Moving into 2025, it looks like the manufacturing sector might be bouncing back a bit, shown by the uptick in the Purchasing Managers’ Index (PMI) hitting 49.3% in December 2024. The number of new orders rising to 52.5% and production reaching 50.3% hints at possible growth after a tough 2024. But this early recovery is happening during a time of serious policy uncertainty as the new administration takes over.

The Trump administration’s suggested tariff plans, especially a potential 10% tax on imports and a whopping 60% on Chinese goods, are a bit of a double whammy for manufacturers. These tariffs aim to protect our own industries, but they could really hit companies that rely on global supply chains and imported parts. Business leaders need to think hard about how these trade policies might affect them and come up with backup plans for different situations.

Manufacturing heads are especially keen on the idea of tax cuts and easing regulations that could give them more freedom to operate and save some cash. Still, they have to weigh these perks against the possible chaos from strict trade policies. Companies with intricate supply chains are already running detailed impact studies and looking into other options, like bringing things back home and working with local suppliers.

Small and medium-sized businesses, especially those into CNC machining, are facing tough choices balancing these pressures. A lot of them are hopeful about lighter regulations, but they also have to figure out how tariffs could affect their edge and their ties with larger manufacturers.

Digital Transformation and Tech Integration

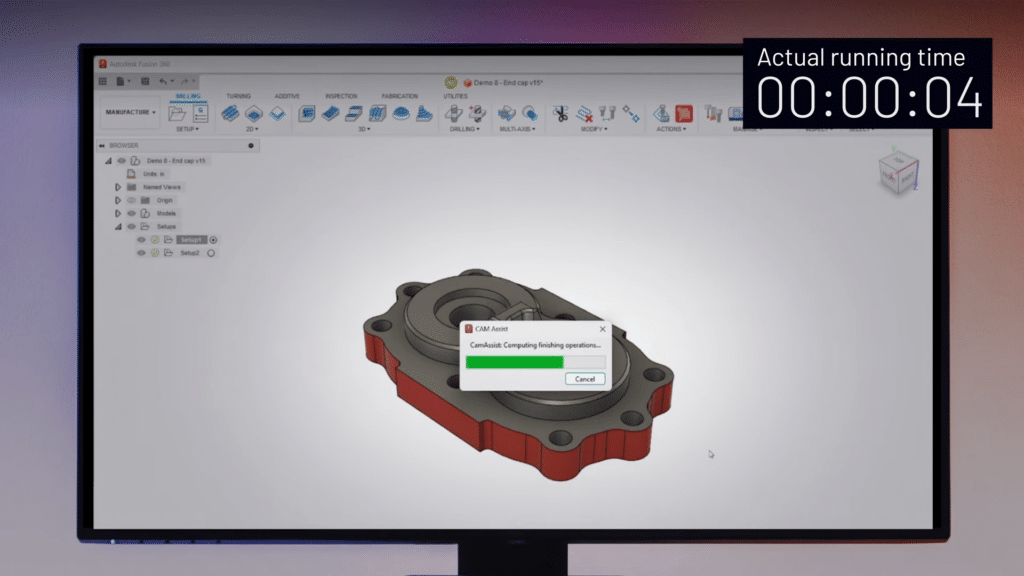

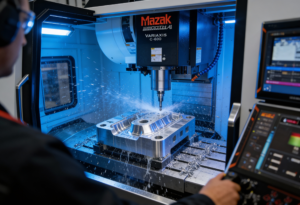

The manufacturing game is changing fast, with digital transformation becoming a make-or-break situation. Automation is set to jump from 69% to 79% in the next ten years, and this change isn’t just nice to have anymore—it’s a must to stay competitive in our tech-focused market. Smart manufacturing is taking center stage, thanks to AI and machine learning becoming part of daily operations.

CNC shops are leading the charge here, with many putting in advanced automation that works smoothly with what they already have. Using digital twin tech, smart maintenance systems, and AI for quality checks are turning the old ways of manufacturing on their head. These investments may cost a lot, but they’re essential to tackle labor shortages and keep their competitive edge.

As manufacturing steps further into digital waters, cybersecurity is becoming crucial. With the Cybersecurity Maturity Model Certification (CMMC) rolling out in early 2025, there’s a lot more to handle for defense contractors and their suppliers. Leaders in manufacturing need to make sure their digital changes come with strong security measures to protect both their IT and operational technology systems.

Adopting Industry 4.0 tech will require serious cash and workforce training. The companies that are doing it right see digital change as a total plan, not just a bunch of separate projects. It’s about mixing technology, people, and processes in a smart way.

Supply Chain Resilience and Reshoring Initiatives

Heading into 2025, the push for stronger supply chains is a big deal in manufacturing. After seeing what happens during global disruptions, many companies are rethinking how they build their supply chains. They’re diving into reshoring and finding new suppliers to be more resilient.

These moves align with the administration’s “America First” manufacturing plans, but actually making it work is tricky. How well reshoring efforts do depends a lot on things like the skill levels of the local workforce, the readiness of infrastructure, and having a strong network of suppliers. Leaders in manufacturing are finding out that building sturdy supply chains isn’t just about moving production back home; it’s about creating a whole ecosystem that supports them.

Places like aerospace and automotive are stepping up with better risk management strategies for their supply chains. They’re using advanced analytics for clearer visibility, finding new suppliers, and investing in local production capabilities. The focus has shifted from just-in-time methods to making sure they can adapt and stay strong in the long run.

Conclusion

As manufacturers tackle the twists and turns of 2025, they’ll need to juggle many things: getting ready for trade policy shake-ups, speeding up digital transformation, strengthening supply chains, and managing workforce hurdles. The incoming Trump administration brings both chances and challenges. Manufacturing leaders have to keep their eyes on long-term goals while also being quick to react to short-term policy shifts.

The industry’s success will really depend on how well companies can blend new tech, develop their workers, and create resilient operations, all while navigating a changing policy landscape. Those who can balance these different demands while keeping their operations running smoothly will have the best shot at success in 2025 and beyond.