U.S. manufacturing employment has not only recovered from the pandemic era recession, but it has surpassed pre-COVID levels in a remarkable turnaround. It is the first time since the 1970s that the sector has recovered all the jobs lost in a recession, a sign of a possible turnaround in the long-term decline in manufacturing employment.

National Recovery

Manufacturing employment reached a total of 12.9 million workers in 2023, more than in 2019 (12.8 million). The recovery follows a year in which the sector lost 650,000 jobs in the COVID 19 recession. Strong growth in consumer demand for goods, such as appliances, furniture, and automobiles, has driven the rebound.

Regional Disparities

The overall positive trend however has been geographically uneven. Almost half of the country’s states and half of all counties have not yet regained 2019 manufacturing employment levels. Much of the recovery is in the Sun Belt and Mountain West, while the Rust Belt’s traditional manufacturing stronghold remains in a funk.

Five states account for nearly two-thirds of all new manufacturing jobs created since 2019:

- Texas: Added over 49,000 jobs

- Florida: Gained nearly 37,000 jobs

- Georgia: Just above 20,000 jobs increased.

- Utah: Grew at 11.8% relative to the fastest.

In contrast, the Rust Belt states (Pennsylvania, Ohio, Indiana, Illinois, Michigan and Wisconsin) have lost 58,000 manufacturing jobs (-1.7%) between 2019.

Manufacturing Geography Shift

Since 2019, manufacturing growth has shifted from rural areas to small urban counties, where 61 percent of new manufacturing jobs have been added. The trend is a broader geographical shift of the sector in the south and west of the country.

Industry-Specific Growth

Most manufacturing industries have expanded more slowly post pandemic than in the 2015–2019 period, but computer and electronics manufacturing has been an exception. However, this sector has seen great growth, probably due to the post pandemic semiconductor boom.

Future Outlook and Challenges

Manufacturing’s role in the U.S. job market continues to decline despite the positive recovery. The sector employed about 18 million workers, or 31 percent of private sector employment, in 1970. By 2023, this share had dropped to 9.7%.

The biggest long term challenge to the sector’s growth is a lack of labor. To do this, some firms are proactively building a pipeline for future workers, beginning as early as middle school.

In addition, the manufacturing sector is being challenged more than ever to compete for entry level workers who now have much higher wages than before in retail and hospitality sectors. This has resulted in a disappearing wage premium for manufacturing jobs: the average manufacturing worker now earns $1.12 less per hour than the average private sector worker.

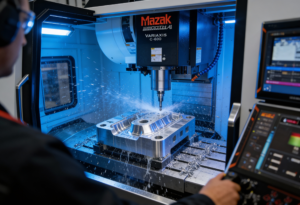

In response to these challenges, some U.S. manufacturers are investing more heavily in automation, with orders for industrial robots increasing sharply in 2021 and early 2022.

The manufacturing sector’s ability to sustain this recovery and propel future growth will depend on its ability to navigate these challenges and capitalizing on these new opportunities in high tech and advanced manufacturing processes.

Resources & Sources:

- https://www.thomasnet.com/insights/u-s-manufacturing-employment-recovers-from-pandemic-era-r

- https://eig.org/manufacturing-rebound/

- https://www.axios.com/2024/10/09/manufacturing-jobs-now-exceed-pre-pandemic-levels

- https://www.stlouisfed.org/publications/regional-economist/2022/jul/labor-constraints-challenge-resurgent-manufacturing-sector